最新文章

文章分类

归档

2005 (1235)

2006 (492)

2007 (191)

2008 (735)

2009 (1102)

2010 (315)

2011 (256)

2012 (203)

正文

Is the Market at a Turning Point? by David I. Templeton

On March 9th many investors were glad to be holding sizable cash balances in their investment portfolio when the S&P 500 Index hit an intra day low of 676. Since that time the S&P has moved higher by nearly 36%. Now investors are lamenting the fact they are holding cash that is earning very little interest. Keep in mind, the Fed's goal is to get investors to move out of cash into more risky investments.

We are at the point where the "less bad" news is viewed as good by the market. Appropriately, economic data that is getting less worse is a positive, but data, like unemployment, needs to turn into employment growth. Losing 500,000 jobs is still bad although it isn't as bad as losing 600,000 job like we have seen recently.

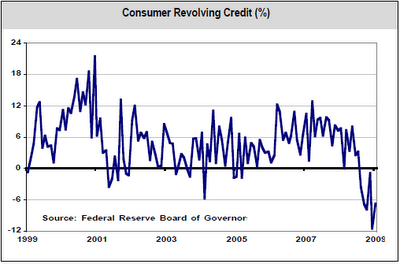

Several discouraging pieces of data in the short term are related to consumers. Consumer revolving credit continues to decline. Record job losses are contributing to the credit decline.

We are at the point where the "less bad" news is viewed as good by the market. Appropriately, economic data that is getting less worse is a positive, but data, like unemployment, needs to turn into employment growth. Losing 500,000 jobs is still bad although it isn't as bad as losing 600,000 job like we have seen recently.

Several discouraging pieces of data in the short term are related to consumers. Consumer revolving credit continues to decline. Record job losses are contributing to the credit decline.

Source: Federal Reserve Bank & Argus Research

Source: Federal Reserve Bank & Argus ResearchIn the long run, reducing consumer debt is a positive as the consumer is too leveraged at the moment. However, short term, reduced consumer spending is a drag on GDP growth since consumer spending has accounted for 70% of GDP growth. So where does economic growth come from?

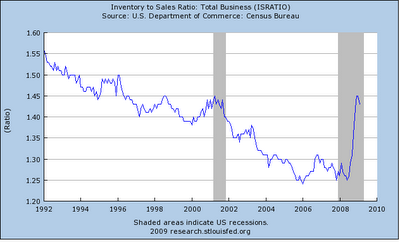

The level of inventory remains bleak, but additional data will be released on Wednesday regarding inventory levels.

The level of inventory remains bleak, but additional data will be released on Wednesday regarding inventory levels.

(click to enlarge)

Source: Federal Reserve Bank St. Louis

Source: Federal Reserve Bank St. LouisAs I have noted in earlier post, once inventory gets down to a low enough level relative to sales, companies will need to produce additional goods. This will stimulate some economic growth.

Lastly, the bull market run has seen a majority of stock prices move higher. The percentage of NYSE stocks that are trading above their 50 day moving average is over 90%.

Lastly, the bull market run has seen a majority of stock prices move higher. The percentage of NYSE stocks that are trading above their 50 day moving average is over 90%.

(click to enlarge)

Yesterday's market action saw a rotation into some of the defensive sectors in the S&P 500 Index. The health care sector was up 4.08% and the staples sector increased 3.08%. The economically sensitive sectors saw declines: industrials down 2.46% and technology down 1.64%.

Yesterday's market action saw a rotation into some of the defensive sectors in the S&P 500 Index. The health care sector was up 4.08% and the staples sector increased 3.08%. The economically sensitive sectors saw declines: industrials down 2.46% and technology down 1.64%.A market correction at this point that consolidates recent gains would certainly be healthy.

评论

目前还没有任何评论

登录后才可评论.